*** THIS SCHEME HAS BEEN WITHDRAWN AND CORONAVIRUS JOB RETENTON SCHEME (CJRS) HAS BEEN EXTENDED (31/10/20) ***

Today (22/10), the UK Chancellor has announced an major update to the Job Support Scheme, targeted at businesses that remain open in Medium and High Risk Areas, yet still affected by lower demand for business.

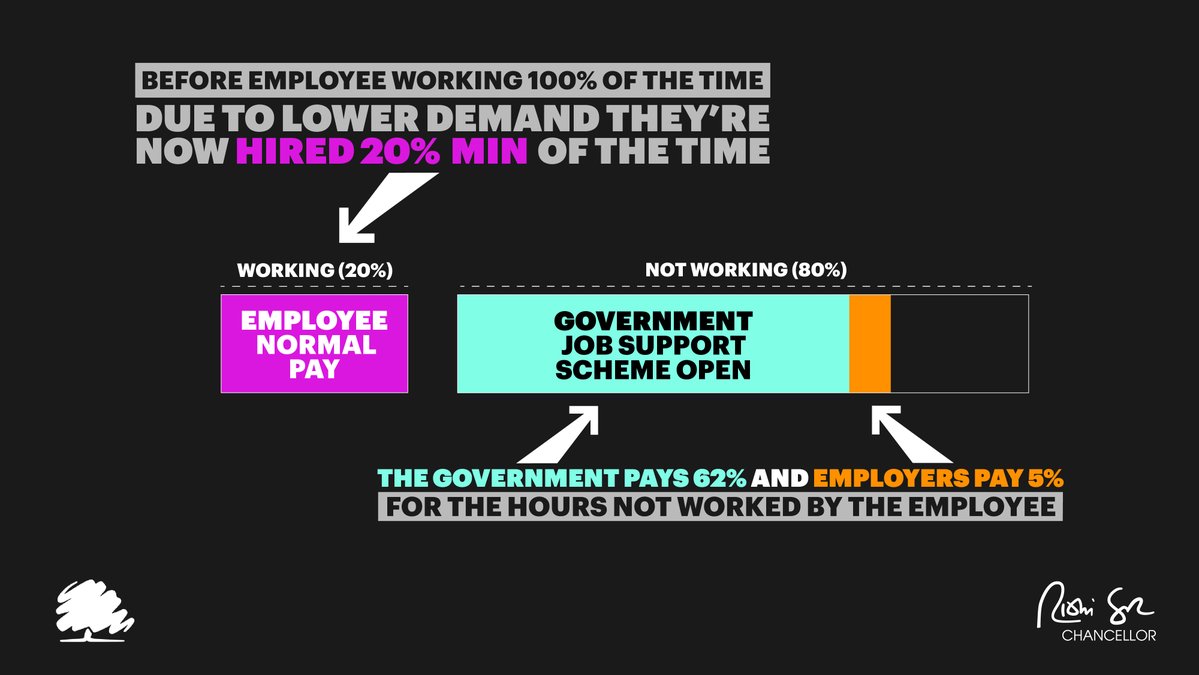

When originally announced, the JSS – which will come into effect on 1 November – saw employers paying a third of their employees’ wages for hours not worked, and required employers to be working 33% of their normal hours.

New Changes

- Employer contribution for unworked (previously referred to as “furloughed hours”) is now only 5%, paying 100% for any hours worked.

- Employees now only need to work a minimum of 20% of hours, which was previously stated as 33% of their usual hours.

Working Example

- A typical full-time employee in the hospitality industry is paid an average of £1,100 per month. Under the Jobs Support Scheme for open businesses, they will still take home at least £807 a month. All the employer needs to pay is a total of £283 a month or just £70 a week; the government will pay the rest.

The government will provide up to 61.67% of wages for hours not worked, up to £1541.75 per month (more than doubling the maximum payment of £697.92 under the previous rules). The cap is set above median earnings for employees in August at a reference salary of £3,125 per month.

That means that if someone was being paid £587 for their unworked hours, the government would be contributing £543 and their employer only £44.

Employers using the scheme will also be able to claim the Job Retention Bonus (JRB) for each employee that meets the eligibility criteria of the JRB. This is worth £1,000 per employee.

Last Updated on 1 month by Gary Parsons